do nonprofits pay taxes in canada

There are few supplies that are HSTGST-exempt for nonprofits. Not-for-profit corporations therefore are not necessarily exempt from paying regular corporate taxes under the Income Tax Act.

Rules Of Engagement The Nonprofit Vote

Most are also exempt from state and local property and sales taxes.

. Employees with higher responsibilities or those in supervisory roles typically earn more. Established in 1988 the Charitable Donation Tax Credit CDTC is designed to encourage Canadians to give as much as possible. Non-profits that are not registered charities may have to file a T2 corporate return if they are incorporated andor an information form T1044.

All nonprofits are exempt from federal corporate income taxes. For instance education and health-related nonprofit organizations tend to pay higher salaries. In accordance with the type of nonprofit organization the value of its assets and other factors nonprofit organizations must file.

Otherwise the tax exemption provided would be unnecessary. Understanding GSTHST information for nonprofit organizations can be challengingespecially if your NPO or charity is staffed by. Even a religious institution.

Thus where an organization intends at any time to earn a profit it will not be exempt from tax under paragraph 149 1 l even if it expects to use or actually uses that profit to support its not-for-profit objectives. The answer here depends on whether the organization is a registered charity or otherwise can be considered a non-profit in Canada. Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors.

In Ontario a rebate of 82 of the Provincial portion 8 of the HST. While penalties for non-filing are based on taxable income of which your. Specific types of nonprofits offer more competitive wages.

Charities and not-for-profits ought to ask themselves whether property taxes apply to them in light of this. There are reporting requirements under the Income Tax Act when you incorporate a non-profit organization NPO under the existing Federal or Provincial legislation. I had a file where.

Answer 1 of 3. Not-for-profit corporations are not automatically considered registered charities or non-profit organizations for income tax purposes. You will be required to file a corporate tax return declaring that you are exempt from tax under Part I of the Income Tax Act.

Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations often face heavy financial penalties associated with property taxes. Once accepted a registered charity is exempt from income tax under paragraph 1491f. Not only will the employee pay their share of taxes.

If a non-profit corporate entity is set up in Canada the advantages include limited liability status a permanent presence in Canada and once the non-profit organization is registered it is exempt from paying income tax under Part I of the Income Tax Act. Distinguishing a non-profit organization from a charity. Charities must complete Federal form GST66 and Provincial form RC7066 and file.

Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax Act. You do not have to be a GSTHST registrant to qualify for the rebate. A non-profit organization cannot issue.

Employees collecting a payroll check from a nonprofit or church are just as liable as the rest of us making a living. There are differences between these types of organizations. Not-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency.

The organization will generally be exempt from tax if no part of its income is payable to or available for the personal benefit of a proprietor member or shareholder unless the proprietor member or shareholder is a club society or association whose primary purpose and function is to promote amateur athletics in Canada. Tax assistance for charitable donations has been provided since 1930. If a charity engages in activities outside of its charitable purposes then it can become taxable.

Therefore in Ontario the net HST is reduced to 394. Non-profit organizations are exempt from tax under Part 1 of the Income Tax Act for the portion of their fiscal period where they meet the requirements to qualify as a non-profit organization. The CRA accepts that a 149 1 l entity can earn a profit.

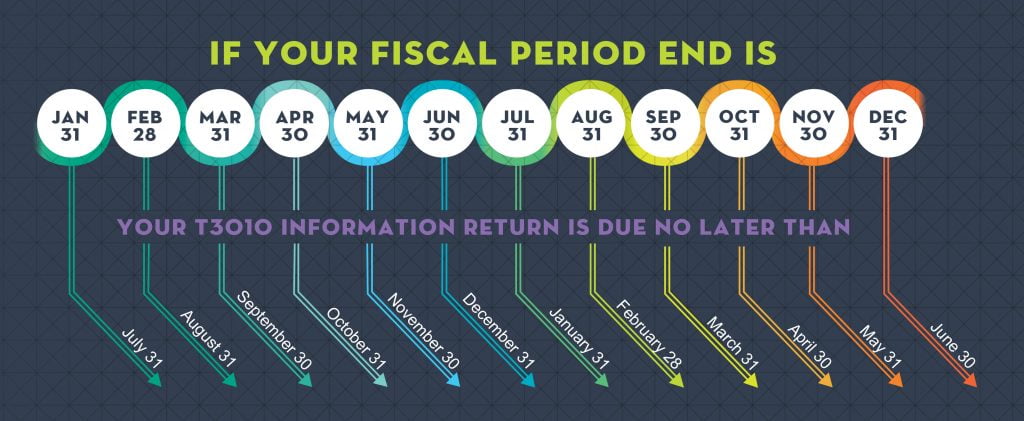

15 on the first 200 of total annual gifts 29 on total annual gifts over 200 with the exception of donors with. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency. In 2017 the federal tax assistance on cash donations.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for-profit company. This exemption applies only to income tax. An NPO cannot be a charity as defined in the Income Tax Act.

Do Non-Profit Organizations Pay Tax. A Canadian nonprofit would not need to pay income tax but they have to use the Canada Revenue Agency in filing their returns. Generally non-profits are exempt from paying income tax except for a few rules around property income or capital gains.

They must pay payroll tax all sales and use tax and unrelated business income. Duties and Responsibilities Involved. Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated to their mission.

Taxes Nonprofits DO Pay. Nonprofits and churches arent completely off of Uncle Sams hook. Under the Act a charity can apply to the Canada Revenue Agency for registration.

Although charitable and nonprofit organizations NPOs are exempt from paying income tax they are still required to pay and collect GSTHST for many of the taxable supplies they purchase and provide within Canada.

Sources And Uses Of Incomes In The Nonprofit Sector

Charitable Giving By Individuals

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Accounting And Bookkeeping For Non Profit Organizations Npo Green Quarter Consulting Surrey Bc

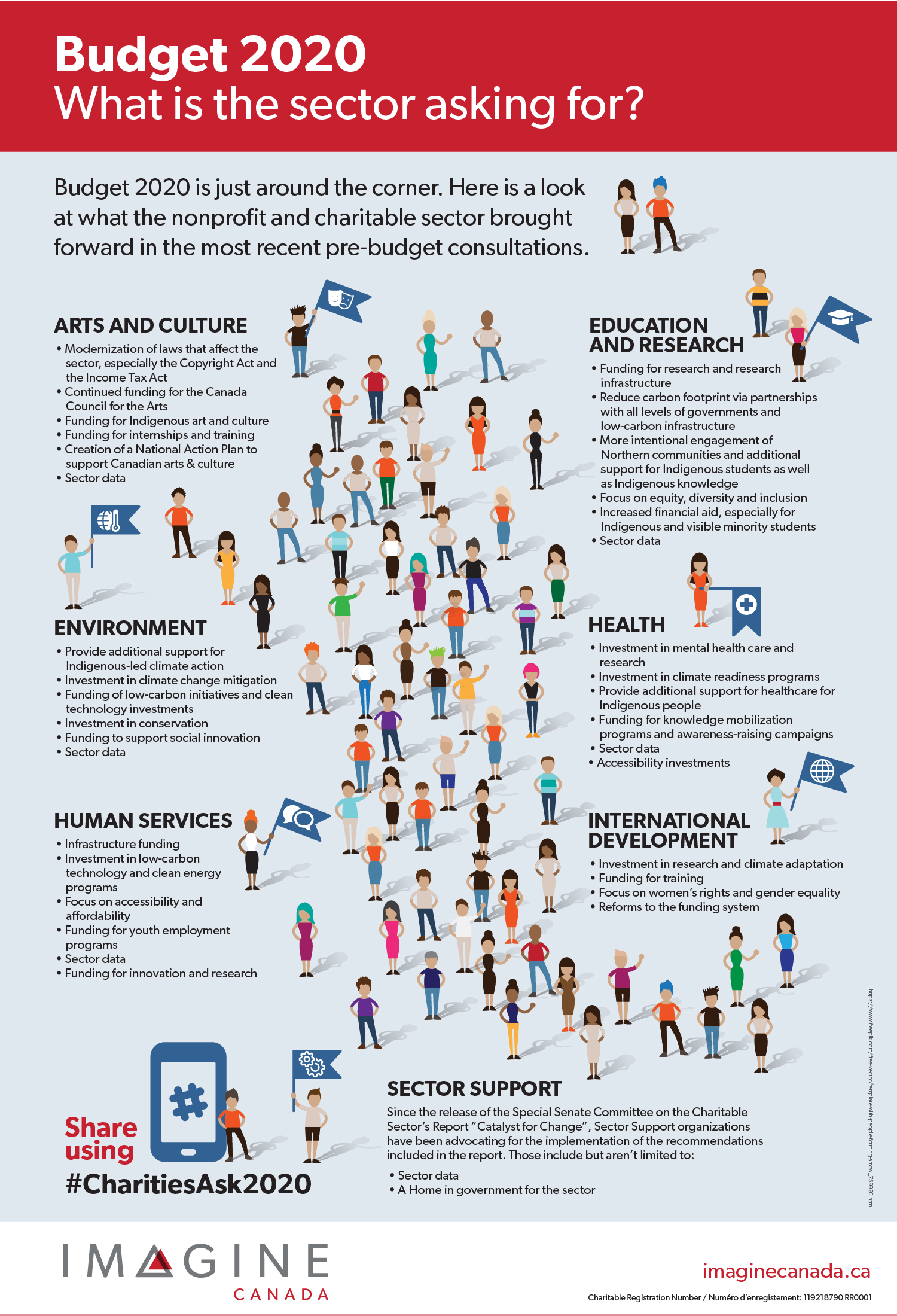

Budget 2020 What S The Sector Asking For Imagine Canada

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Non Profit Vs Not For Profit What S The Difference 2022

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

A Nonprofit Guide To Human Resources Management

Guide To Gst Hst Information For Nonprofit Organizations Enkel

Four Reasons The Nonprofit Sector Needs A New Name Ontario Nonprofit Network

Simple Ways To Start A Nonprofit In Canada With Pictures